我出去旅游之前给团队写的内部信的截取部分「DeFi 这波带给行业长期的价值是什么」。之前中文很多采访应该也提到过大致的逻辑框架。

原文:Dovey Wan

翻译:keyah

流动性挖矿本质上是一种 Proof of Capital (资金量证明,类比 PoW 工作量证明),这种范式本质上和所有的「把你的钱 / 币用起来」的奖励机制是一样的。在 2018 年 CEX 流动性挖矿狂热中,因为巨鲸有更多资本,可以通过类似对敲的方式刷更多的量,所以那一次最大的受益者也一样是巨鲸,当然还有很多类似 PoS 的激励机制,最大的受益者也一样是巨鲸,而不是小散。

长期来看,这一次 DeFi 狂热带来的价值首先在于新项目募资方式的范式转移:让区块链项目的启动回归 fair launch 模式,通过流动性挖矿的方式让项目流动性的冷启动成为可能,同时获得用户对项目的认知、接纳、使用。同时,这次参与流动性挖矿的资金是真的影响了项目发展的,因为 TVL (Total Value Locked)几乎是 DeFi 项目最重要的指标(尽管这个指标其实不那么合理),TVL 的增长无疑是对项目有好处的。相比 2018 年来说,那次仅仅是刷量,这次不是。

所以,现在来看,币圈项目的启动在 VC 私募模式以外有了一个新的模式——fair launch,这当然是给行业带来了价值留存的。从我个人观点看,这种(治理)权力、(代币)价值分发的模式,相比于传统的募资模式,可能还更可持续一些。

其次,用户被流动性挖矿吸引而对 DeFi 生态的自学和使用远远超过了我们的预期,最简单的去看看 DEX 的增长好了。Andre Cronje (YFI 项目创始人)也激励了一些开发者,他们想在链上建立新的产品并且快速推进。在过去,他们要给自己募资是相对困难的,YFI 模式将会减小这些人募资的难度、大大推进有想法的人来启动、实现他们的项目。

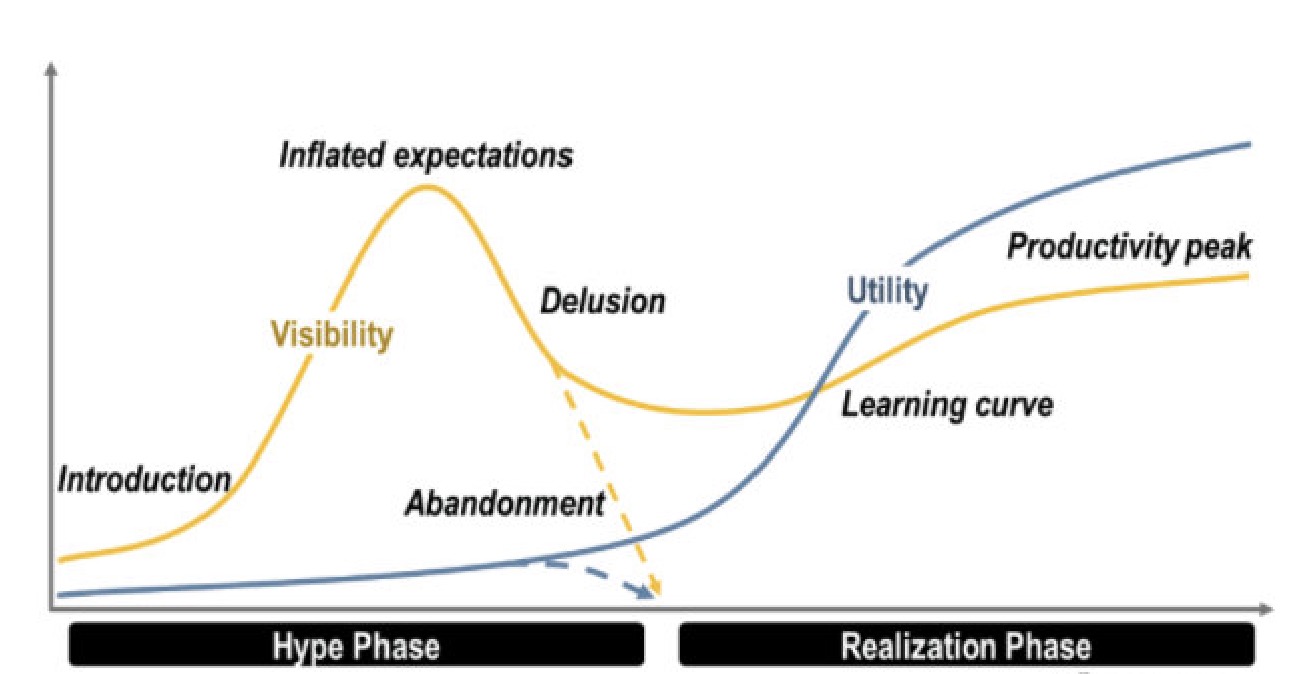

如果我们从长远来看,这次 DOJ 对 BitMEX 的指控其实也是一个对我们的提醒——面对潜在的监管,DeFi 的方式可以让它的影响最小。需要注意的是,创新和落地总是在泡沫中诞生的。以国内移动互联网时代为例,现今的巨头们当初给新用户提供了大量的补贴,无论是 O2O、共享单车、微信/支付宝,都是这样落地的。在用户习惯养成以后,他们都为社会带来了新的范式转移(那么,当初补贴以快速扩张的目的就达到了)。

对于这次的 DeFi 行情,我的看法是类似的,但这次提供补贴的不是某个大公司,而是在二级市场买这些 MEME 币的,或者是某些为这些 MEME 币提供流动性的矿工(换言之就是给这些币定了一个并不合理、不可持续的价格的人)。但总得来说,这次 DeFi 事件仍然是对行业总体有益的。

原文:

Farming is a game of "proof of capital", this is the same for all types of"put your capital at work rewarding program. In the 2018 cex liquidity mining program the biggest beneficiary is also big whales who can wash trade like crazy and many PoS programs are also whales. So the nature of the incentiv design will be in favor of whales instead of small retail. The biggest value of this hype in the long run, first of all it's a shift in fund raising paradigm: bringing the fair launch back to the game where bootstrapping liquidity is possible through farming, quickly gains mindshares and adoption. And this time the capital is real at work due to the importance of TVL for most defi services, instead of wash trade. This will def bring value to the industry as an alternative to the previous VC presale game. This type of power and value distribution mechanism can better sustainable than the trad fund raise imo

Secondly, the adoption and self-education pushed by farming (even just the growth of DEX usage) has also exceeded our expectati. AC also inspired a bunch of builders who want to build stuff and move fast but previously had no idea how to fund themselves, this will spur innovation and reduce friction of launching/building new services.

If we look at the big picture, the recent indictment from DOJ on Bitmex is another alert why we need a true decentralized finance alternative where it can have minimal exposure to potential regulatory haul. Innovation is always born in the bubble and the same as adoption. Chinese internet subsidizes massively to form new user behaviors for stuff like all sorts of online to offline services, bike-sharing, wechat/alipay at the very beginning, and made a complete paradigm shift afterwards when those behaviors are formed and become norms. I see the whole defi money printing somewhat similar, but this time the subsidy comes from who bought those food coins at the secondary, or who provides liquidities (ie. who set the unsustainable fair market value to many defi tokens at some point of time) but still a net positive for the industry as a whole.